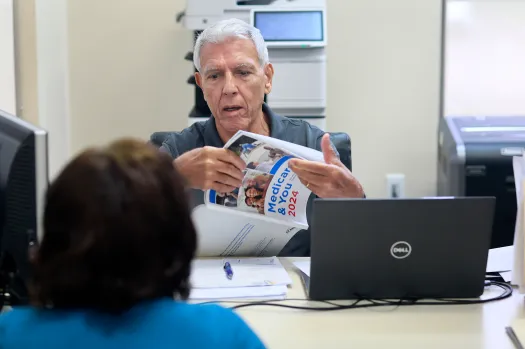

When it comes to Medicare coverage, choosing the right plan can feel overwhelming. Medicare Advantage Plans offer an alternative to Original Medicare, providing a range of options for seniors and eligible individuals. Understanding these plans is key to making a decision that fits your healthcare needs and budget.

What Are Medicare Advantage Plans?

Medicare Advantage Plans, also known as Part C, are offered by private insurance companies. These plans provide the same benefits as Original Medicare (Part A and Part B). However, they may include additional services, such as vision, dental, hearing, and even fitness programs.

While Medicare Advantage Plans must cover everything that Original Medicare does, they can have different rules, costs, and coverage options. Some plans also include prescription drug coverage (Part D), making them a one-stop solution for healthcare needs.

Types of Medicare Advantage Plans

There are several types of Medicare Advantage Plans. Here’s a quick overview:

- Health Maintenance Organization (HMO): Requires you to use a network of doctors and hospitals, with referrals needed to see specialists.

- Preferred Provider Organization (PPO): Offers more flexibility, allowing you to see providers outside the network, but at a higher cost.

- Private Fee-for-Service (PFFS): Lets you visit any doctor or hospital, as long as they agree to the plan’s terms.

- Special Needs Plans (SNPs): Tailored for individuals with specific conditions or characteristics, such as chronic illnesses or being dual-eligible for Medicare and Medicaid.

Comparing Costs

Costs for Medicare Advantage Plans can vary based on several factors:

- Premiums: Some plans have $0 premiums, while others may charge monthly fees.

- Deductibles: This is the amount you pay before your plan starts covering services.

- Copayments and Coinsurance: These are costs you pay when you receive services, like doctor visits or hospital stays.

- Out-of-Pocket Maximums: Medicare Advantage Plans often have a yearly limit on what you’ll pay out-of-pocket for medical services, providing a safeguard against high expenses.

When comparing costs, it’s important to consider what you’ll pay not only in premiums but also in terms of deductibles, copays, and the overall annual cost.

Coverage Options

While all Medicare Advantage Plans must provide at least the same level of coverage as Original Medicare, some plans offer extra benefits. These may include:

- Vision and Dental: Routine eye exams and dental cleanings are often included.

- Hearing: Some plans cover hearing aids and exams.

- Fitness Programs: Many plans offer gym memberships or fitness classes.

- Telehealth: Some plans include virtual doctor visits, which can be convenient for those unable to travel.

It’s important to weigh these extra benefits against the cost to see if they’re worth it for your specific situation.

Choosing the Right Plan

When comparing Medicare Advantage Plans, it’s essential to consider your healthcare needs. Think about:

- Doctors: Do you have a specific doctor or hospital you prefer? Make sure they’re in the plan’s network.

- Medications: If you need prescription drug coverage, ensure your plan includes it or consider a separate Part D plan.

- Specialized Care: If you have a chronic condition or need frequent care, look for a plan that caters to your specific health needs.

Be sure to review the plan’s provider network and read the plan’s summary of benefits to see if it aligns with your requirements.

Why Medicare Advantage Plans Might Work for You

Medicare Advantage Plans can be a great option if you want more coverage than Original Medicare provides. They often come with added benefits, lower out-of-pocket costs, and the convenience of having all your healthcare services in one plan. However, it’s important to evaluate whether the plan’s network, costs, and coverage fit your personal needs.

For those planning ahead, looking into Medicare Advantage Plans 2025 can help you stay prepared for future changes in costs, coverage, and available options.

Conclusion

Comparing Medicare Advantage Plans requires careful consideration of your health needs, budget, and coverage preferences. By understanding the differences in types, costs, and benefits, you can make an informed choice that provides the best care for you. Take the time to evaluate your options, so you can enjoy peace of mind knowing your healthcare is covered.